Bussiness

Stocks shrug off China stimulus disappointment – London Business News | Londonlovesbusiness.com

DIGEST – The S&P closed out its best week in a year on Friday, even as China again disappointed on fiscal stimulus. A quiet docket awaits today, to kick-off the new trading week.

WHERE WE STAND – I suppose that ‘exhaustion’ could well be the best word with which to describe price action on Friday, perhaps unsurprisingly so given the bonanza of event risk that participants have had to grapple with over the last fortnight or so.

To recap, that period has included – the UK’s ‘high spend, low growth’ Budget; a dismal NFP print, skewed lower by hurricanes; President Trump and the GOP’s convincing electoral victory; as well as, 25bp cuts from both the FOMC and the BoE. There’s enough there to cover a month, let alone 10 trading days!

In any case, participants have navigated all of that rather well, and we emerge from the above in an environment that remains a positive one for sentiment. The S&P ground out a gain of just over 0.3% to wrap up the week, though the week as a whole saw the benchmark soaring 4.7% to notch its best week in a year.

I remain bullish, with solid earnings growth, strong economic growth, and the forceful ‘Fed put’ providing a solid foundation for the market to build upon, while cleaner post-election positioning, and expectations that Trump’s proposed stimulus will provide a renewed economic sugar rush, are also helping to move things along rather nicely.

That said, I do think that conditions could start to become relatively thin in quite short order – just like my hair, some would say! We stand just over two weeks away from Thanksgiving which, for many institutional participants, marks the time when books are closed, positions are squared, and the year effectively draws to a close. There’s a case to be made that a lot of that position squaring has been done earlier than usual this year, owing to the election, with anecdotal evidence suggesting that a lot of desks have indeed already, effectively, called it a year. Something to keep on the radar if volumes start to lighten up a little in coming weeks.

Back to Friday, and the gains in the equity complex came despite China – again! – disappointing in terms of fiscal stimulus. The eagerly-anticipated NPC meeting turned out to be an almost complete ‘damp squib’, with authorities simply confirming that the 6tln CNY local government debt swap plan, that had been announced some time ago, had been approved.

It seems that China could well be keeping some fiscal powder dry until Trump takes office, in order to cushion the blow of any tariffs that may well be imposed after the inauguration in January. That won’t do much to soothe market nerves in the ‘here and now’ however, and certainly doesn’t alter my longstanding view of not wanting to touch the Chinese market with a 10ft bargepole, given that the stocks one buys are yours, until the government decides that they’re not anymore.

Away from the equity space, the week wrapped up with a day of rather broad-based USD gains, with the antipodeans underperforming, largely a result of the aforementioned China stimulus disappointment.

Setting that aside, though, the USD bull case remains a convincing one, with US economic outperformance still clear for all to see, and with risks around the FOMC outlook becoming somewhat more two-sided into 2025, amid Trump’s reflationary fiscal agenda, and the inflationary risks posed by the imposition of tariffs.

In light of that, it could perhaps be seen as a little surprising that we haven’t seen more sustained selling pressure at the long-end of the Treasury curve, with benchmark 10-year yields now trading around 15bp below their election night highs.

To me, I see this as a sign of investors stepping in to lock in yields around current levels, which is a logical course of action given the likelihood of the FOMC taking the fed funds rate back to neutral, around 3%, by next summer. Still, given higher inflation, and growth, expectations, a steeper curve seems like the way to play things for now.

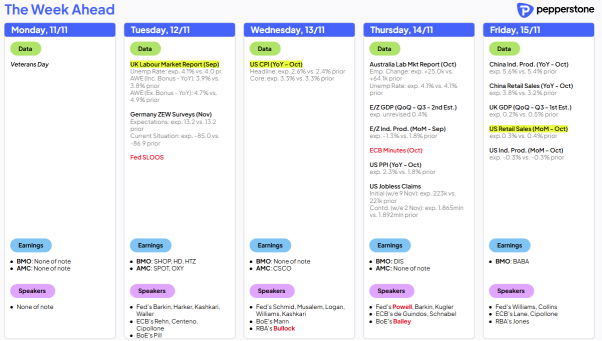

LOOK AHEAD – The day ahead looks set to be a subdued one, as the calendar below shows. In fact, the week as a whole looks like it will struggle to live up to the fanfare of the last fortnight, though I suppose we should all be grateful of the somewhat less hectic conditions!

Today is, of course, Remembrance Day, or Veterans Day in the US. We should all take a moment to remember those who paid the ultimate sacrifice, and all those who have served, for us to enjoy the freedom that we do today:

They shall grow not old, as we that are left grow old:

Age shall not weary them, nor the years condemn.

At the going down of the sun and in the morning

We will remember them.