Bussiness

Bitcoin sets new all-time highs, but will it be a digital gold? – London Business News | Londonlovesbusiness.com

Cryptocurrencies are celebrating, and the reason for the ongoing bull market is clear. Donald Trump won the U.S. presidential election, and Republicans are close to taking over Congress.

Control of the Senate and House of Representatives can ensure the smooth implementation of cryptocurrency industry-friendly legislation. A positive message built around Bitcoin and the blockchain industry was, after all, an important part of Trump’s presidential campaign.

Since the Republican front-runner’s win, the price of Bitcoin has already risen by 20%.Such a favorable turn of events for the industry comes as a surprise to even the biggest optimists… It also gives room to build expectations around the next catalysts for growth. The crypto market loves speculation and dreaming up hypothetical scenarios. And this time there is plenty to dream about, as Republican initiatives indicate a desire to create a Bitcoin strategic reserve. Will the U.S. buy and ‘scrape from the market’ more than 1 million Bitcoin?

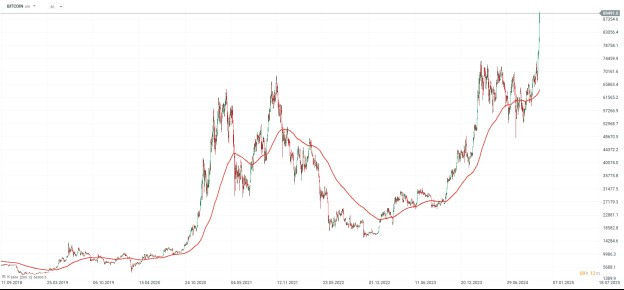

Bitcoin has had more than a dozen years of astronomical increases, with its price rising from a fraction of a dollar to $90,000 today. Fanatics argue the rise is due to limited supply and point out that it was created to fight inflation. This according to the Austrian School of economics is largely derived from the actions of central banks. Source: Bloomberg Finance LP.

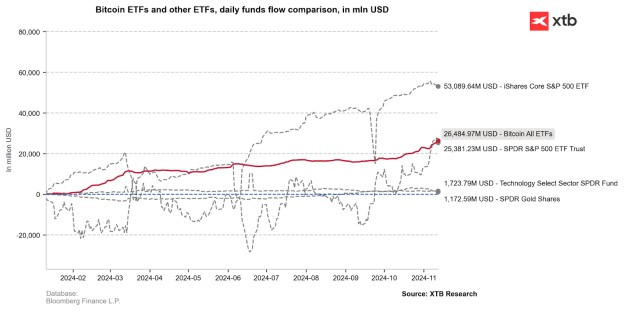

In a wave of ongoing euphoria, the dream of $100,000 for BTC looks ever closer to fulfillment. The cryptocurrency has now reached $90,000, while in the ‘bottom of the 2022 slump’ investors were selling their BTC for $15,000. This is a sixfold increase over the last two years. After a 100% price increase in 2024, Bitcoin has equaled the value of the global silver market, at $1.7 trillion. U.S. ETFs alone have pooled $25 billion worth of Bitcoins this year, making a fortune for their issuers like BlackRock and Fidelity.

The popularity of ETFs this year has been enormous. Cumulative net inflows into them have exceeded the SPDR S&P 500 ETF Trust by more than a billion dollars. With the capitalization of the companies in the S&P 500 index now standing at $50 trillion, compared to Bitcoin’s $1.7 trillion valuation. In Europe, in the absence of regulations allowing the creation of spot ETFs for retail investors, Bitcoin ETNfunds are popular. Currently, the size of the Bitcoin market is similar to silver, which has had solid gains this year. However, it is still nearly 10 times smaller than gold. Will Bitcoin in the future become a reserve currency alongside bullion? Such a scenario still sounds like an abstract one… But cryptocurrencies like to surprise. Source: XTB Research Bloomberg Finance L.P.

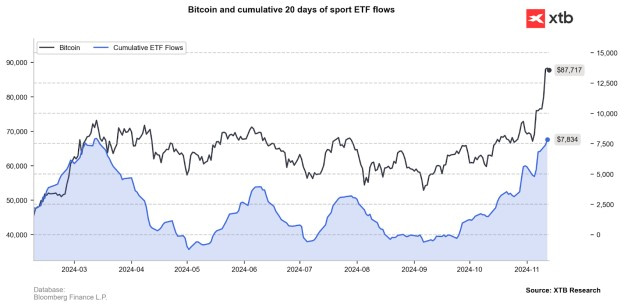

Inflows into ETFs are fueling Bitcoin and have been rising since October. Source: XTB Research Bloomberg Finance L.P.

Cryptocurrencies – an echo of changes in the US?

Donald Trump is building a narrative of ‘declaring war on the establishment’ in the United States. Proof that this time it doesn’t have to be just empty declarations is the announcement of the creation of an entirely new position, which the president-elect intends to give to Elon Musk, appointing him secretary at the Department of Government Efficiency (DOGE). It didn’t take long for the Dogecoin cryptocurrency associated with Musk to react. Its price has doubled since the election.

Cryptocurrencies, as ‘anti-system’ tinged assets, seem to complement Trump’s overall campaign, built on criticism of existing structures. Now investors have an open path to speculate on the accelerated ‘adoption of blockchain technology’ and the consolidation of Republican influence around the digital asset industry. The secondary issue today is whether the popularity of cryptocurrencies in the realm beyond speculation will actually increase. What matters to the market is that maybe that’s what’s at stake.

It is well known today that Trump’s win does not please everyone on Wall Street. The president-elect himself commented that financial institutions and banks have begun to abuse their power. Such words in the mouth of the US president sound surprising and give cryptocurrencies some signal that they can count on positive sentiment from the new White House administration. Even more so if we consider that Donald Trump is trying to create his own family crypto-business under the banner of World Liberty Financial.

This ‘meaningful’ name must appeal to cryptocurrencies fans, oriented on ‘Satoshi’s vision’. Trump’s attempt to populrayalize decentralized finance may be one of the guns that Trump will target the ‘financial mainstream’…. Whether he succeeds, however, is a separate story, because while cryptocurrencies are nothing new, the scale of adoption is small; still most ‘Westerners’ choose traditional banking.

The cryptocurrency market today buys a positive picture of the future, and this may turn out to be a mirage. Similarly, the future of industry regulation is not clear today. However, it seems certain that the post will sooner or later leave the hostile to the cryptocurrency sector, SEC Director Gary Gensler. Trump has already proposed his own ‘nominees’ for the position. From dozens of scattered puzzles, the market is today putting together a picture that leads to an almost unambiguously ‘positive’ conclusion.

Growth catalysts

Forecasting market Kalshi estimates a 60% probability of Bitcoin surpassing the ‘magic’ $100,000 mark later this year. Investor optimism is on the rise, and powerful capital has again injected into the smaller cryptocurrencies that follow Bitcoin’s lead. The prospect of sector-friendly regulatory changes in the U.S. may indeed be a catalyst for growth for projects such as Ethereum, or smaller cryptocurrencies offering real ‘utility’. An explosion of interest in speculative tokens known as Memcoins is also evident.

U.S. stock exchange Coinbase has already launched the price-tracking 50-biggest projects index Coin50, which is intended to be the equivalent of the stock market’s S&P 500. Submitted on July 31, 2024, by Wyoming Republican Cynthia Lumnis ‘Boosting Innovation, Technology and Competitiveness through Optimized Investment Nationwide (BITCOIN) Act ‘ is supposed to allow America to ‘hedge’ the growing and already nearly $36 trillion budget deficit… with Bitcoin.

Admittedly, Trump intends to cut government spending in unproductive spheres and make the administration less ‘dollarized,’ but… that doesn’t mean his goal will be a significant reduction in the deficit. At least not an obvious one, since the program proposed by the Republicans does not indicate that belt-tightening in the US will become a priority for the administration.

Summary

The cryptocurrency market is supported by a bull market in global markets and an appetite for risk. Central banks are also gradually lowering interest rates, and a recession and collapse in consumer sentiment is still not in sight. If the Republicans eventually pass the ‘Bitcoin Act’ and the United States starts buying hundreds of thousands of Bitcoins every year, we can successfully imagine that the situation could be perceived as a precedent for other countries, pension funds, or companies that can ‘token 1%’ invest precisely in BTC.

The United States has already made some steps to ‘consolidate the cryptocurrency industry’ in the country. Chicago-based exchange CME Group is a leader in trading BTC contracts and options, and U.S. ETFs have already absorbed more than $27 billion worth of Bitcoins this year. But let’s not get carried away by emotions, because, the cryptocurrency market likes to consume optimistic events before they even happen. Each of the previous euphoria ended in a crash. This time, too, the clock is probably ticking. The question is, how long a distance do its hands have to travel?

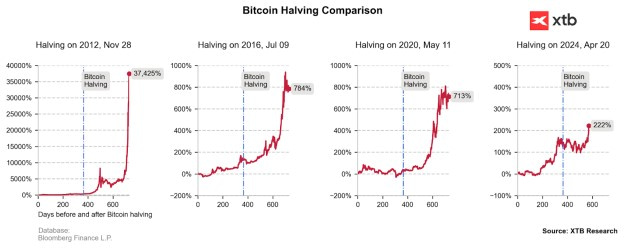

Does the story rhyme? After this year’s halving in April, Bitcoin’s price began to rise rapidly again. This time, however, it is not halving, but purchases of ETFs created in January 2024 that are largely leading to a reduction in supply. However, given a capitalization approaching $2 trillion, it’s hard to imagine that Bitcoin will have a similar scale of increases ahead of it as in previous cycles. Source: XTB Research, Bloomberg Finance L.P.

Bitcoin chart (D1 interval)

Source: xStation5