Bussiness

FOMC thoughts: From pivot to patience

Markets appear to have, finally, begun to react to the implications of the FOMC’s continued data-dependent stance, with the ‘higher for longer’ narrative coming back into vogue once more.

While geopolitical developments have been at the forefront of participants’ minds of late, there has also been a heavy focus on the monetary policy outlook.

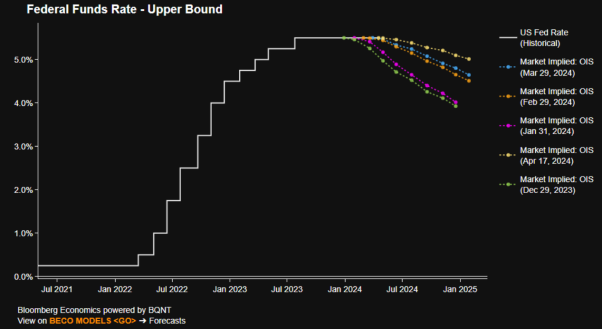

This is understandable, after three straight hotter than expected US CPI prints in a row, and a worrying reacceleration in so-called ‘supercore’ CPI to 4.8% YoY last month. Traders have not only hawkishly repriced the implied Fed rate path, some have even questioned the FOMC’s reaction function more broadly.

It is this latter point that seemingly makes little sense, given that the FOMC are doing almost exactly what they told us they would.

Back in December last year, the FOMC ‘pivoted’, as Chair Powell noted that the Committee “discussed the timing of rate cuts” during the final FOMC meeting of last year. However, this pivot came with a caveat – namely, that rates may have to remain ‘higher for longer’ if upside inflation risks were to emerge.

A similar narrative was present in January. Here, Powell noted that while officials believe that the fed funds rate had “likely” peaked for this cycle, a March cut would likely not be appropriate, and that any such cut would be off the table until “greater confidence” had been obtained that inflation was on its way sustainably back towards the 2% target.

This is, broadly, the message that has been repeated since, both in various speeches, and also at the March FOMC, where Powell & Co reiterated that policymakers require more confidence on inflation in order to cut rates.

In the time since the March FOMC meeting, incoming data has – undoubtedly – not provided the confidence that policymakers are seeking. As noted, inflation has continued to surprise to the upside, even if the Fed’s preferred price gauge – the core PCE deflator – has shown a continued disinflationary trend. Furthermore, the labour market has remained resilient, while growth has remained substantially above trend, both factors which will contribute little in terms of disinflationary progress.

Hence, in reaction to this lack of progress, the FOMC have done, and are signalling, exactly what they told us they would – that rates will remain where they are, until policymakers see the progress that they seek. In other words, we’re back to ‘higher for longer’ once more.

What is, perhaps, most interesting among all this, is that financial markets have only just begun to wake up to this reality, in the hawkish repricing that has seen the curve now price just 40bp of easing over the remainder of the year. Note that this repricing has not been triggered by a shift in the tone of Fedspeak, rather having been caused by a shift in incoming data. Markets, then, may be becoming as data-dependent as the FOMC are.

This is, in essence, precisely how a data dependent policy stance should work; as the data evolves, so does the policy outlook.

Of course, this also means that such a policy stance comes with inherent uncertainty. It is, by its very nature, impossible to pin a precise date as to when the first rate cut will come – in contrast, for example, to the ECB, who have effectively pre-committed to a June easing – when one is beholden to the evolving economic situation, rather than to the calendar.

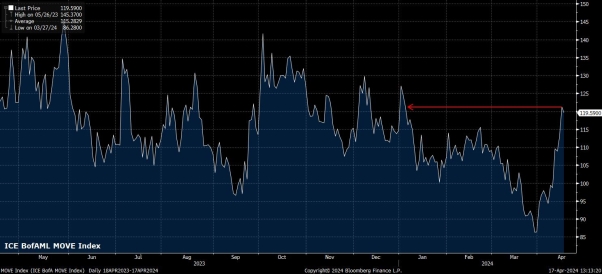

While this will make life rather difficult for the sell-side, and for analysts making their FOMC calls, it is likely to be good news for day traders. This is because the guessing and second-guessing as to when the first cut will come, as well as the diverging FOMC-RoW policy outlooks, should see rates vol continue to move higher. BofA’s MOVE index, for instance, has already risen to its highest since January, as Treasuries have sold-off to YTD yield highs across the curve, and looks set to remain elevated.

This, however, is not necessarily the case for equities. While stocks have endured a geopolitically-induced pullback from recent highs, taking the S&P 500 back below its 50-day moving average for the first time since November, the medium-run backdrop remains a bullish one.

There are a handful of reasons for this, not all of which involve the policy outlook. For instance, continued above-trend GDP growth should continue to support a solid pace of earnings growth.

That said, the policy backdrop is perhaps the most supportive factor for risk assets over the medium-term. Although rate cuts are likely coming later than markets had expected, the direction of travel for monetary policy remains the same, with the next move in the fed funds still set to be downwards.

As such, so long as rhetoric from the FOMC remains along the lines of being ‘in no rush to cut’, and words to the effect of ‘prepared to hike again’ aren’t spoken by Chair Powell, the Fed put will remain alive and well, meaning that the path of least resistance should continue to point to the upside.