Bussiness

Intel near 12-year lows, is this an opportunity? – London Business News | Londonlovesbusiness.com

Intel, one of the technological pioneers that stands today at the crossroads of its history.

From its domination of the PC processor and server markets to its struggles with technological delays and competition, Intel’s path has been eventful.

Under the leadership of CEO Pat Gelsinger, the company has embarked on an ambitious transformation strategy. It seeks to regain its technological edge and expand into new markets.

With a share price at 2012 levels and a valuation close to liquidation value, Intel represents a risky, contrarian opportunity for patient investors.

The success of the IDM 2.0 strategy and the 18A technology process, could change the company’s fortunes and bring it back to the forefront of semiconductor manufacturing. However, all problems that Intel faces off are definitely real, and may be even more paintfull, if company will be not back to profitability or will not signalize that in the near-term.

Unprecedented since 2000 crash on Intel shares makes speculations about company ‘failed future’, similiar to Nokia or Kodak, which were also dominants for a long time… But lost their position to more dynamic competitors, amid reshaping technology landsacpe. The question remains: Is Intel cheap and investment opportunity or so-called value trap? One thing is sure, Intel will fight for its future, and will cut almost 15000 jobs to support backing to profitability. Is that enough? Probably not. Let’s dive in.

From dominance to problematic transformation

Intel, founded in 1968, led the semiconductor industry for decades, especially in the processor segment. However, delays in the development of advanced manufacturing processes, competition from AMD and Nvidia, as well as changes in the technological landscape related to the development of artificial intelligence, have put Intel’s business in a difficult position. The company missed an opportunity related to tariffs on non-U.S. products.

Now the lost race for AI and data centers has led to a drop in share prices to 2012 levels. Investor confidence is down on the competition. Nevertheless, the low price level may represent an opportunity for long-term investors. The company is in the midst of a transformation under CEO Pat Gelsinger, who returned to the company in 2021 with a mission to restore it to its former glory. The plan is to return to a leadership position in legacy products and expand into new areas.

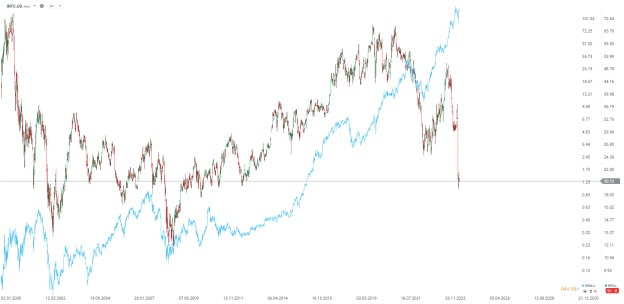

Against its competitors, Intel looks pale, considering not only the last year, but basically the last five years. Source: Bloomberg Finance LP, XTB

Will revenue diversification help it survive?

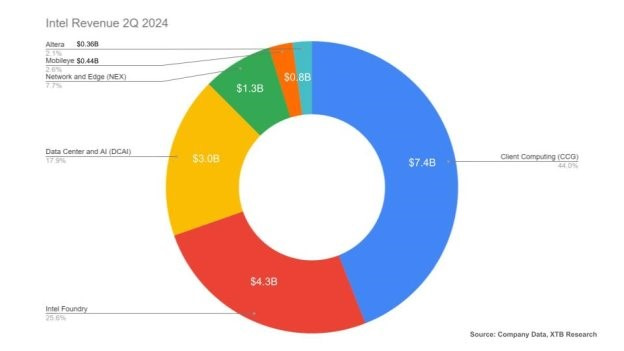

Intel is a technology giant whose business is based on several main areas:

- Personal Computers and Mobile Devices (CCG): This is the largest and most recognizable segment, generating more than half of revenues (PC processors, mobile)

- Data centers and artificial intelligence (DCAI): the second largest segment, (processors and solutions for servers and artificial intelligence systems. It is key to the development of cloud computing and advanced data analytics.

- Networks and edge devices (NEX): This segment is responsible for the development of 5G technologies, edge computing and the so-called Internet of Things (IoT). This is an area with high growth potential, driven by the increasing demand for fast and efficient networks.

- Other segments: In addition to the three main areas, Intel is investing in autonomous driving technologies (Mobileye), third-party chip manufacturing (IFS) and programmable logic chips.

Declining margins are currently one of Intel’s key challenges. Gross margin has fallen from historical levels of 55-60% to around 38-40% in recent quarters. The main reasons for this are high spending on developing manufacturing technologies and maintaining the pace of competition. Intel is struggling with production efficiency issues due to lower capacity utilization, as well as a general slowdown in the PC and server market after the pandemic boom. Restructuring costs (planned job cuts of 15%) illustrate the company’s more difficult financial situation. Source: XTB Research

Why is Intel valued near liquidation value?

Intel’s tangible book value per share (TBV) is currently around $19.51. This is the book value of all net assets per share of the company, after subtracting intangible assets. This value reflects significant tangible assets, including chip factories in the US, Israel and Ireland worth about $80 billion. In addition, Intel has tremendous intellectual value in the form of thousands of patents related to semiconductor technologies and unique know-how in chip design and manufacturing.

The company also has significant cash and short-term investments, which amounted to about $29 billion at the end of the second quarter of 2024. Added to this are strategic investments such as a stake in Mobileye, an Israeli company specializing in autonomous driving technologies, and other investments in promising start-ups and future technologies.

The reason why Intel’s valuation is now so ‘low’ is that the company is no longer profitable, is burning cash, has suspended planned dividend payments, (it has been paying them for decades), and faces huge investments to catch up with ‘departing’, younger competitors.

Sleepy bull market remains visible on indicators

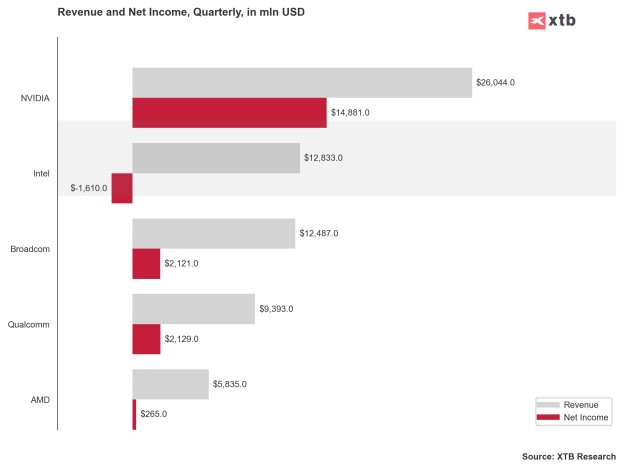

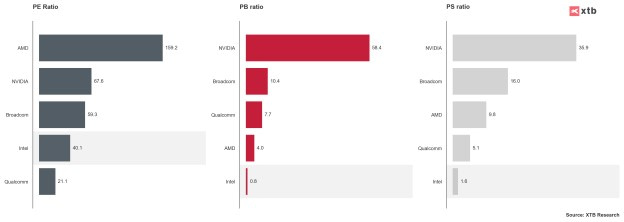

Looking at the price indices for Intel, we can see quite a disparity compared to the competition. Intel is trading at significantly lower valuation ratios than NVIDIA, AMD or Broadcom.

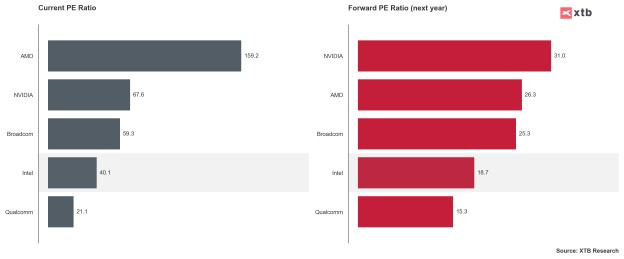

The price-to-earnings ratio for Intel is currently lower than that of its competitors, but this is due to Intel’s strong recent decline in profits. In view of this, the price-to-earnings forecast ratio is worth noting. A very low valuation is also presented by the price-to-book-value ratio, which is below ‘one’, which is evident in the case of companies that are in trouble or operate in industrial or energy sectors.

Similarly, the price-to-book-value (P/B) ratio for Intel is the lowest in the group at just 0.8, while it reaches 58.4 for NVIDIA. The price-to-sales (P/S) ratio also places Intel at the bottom of the pile with a value of 1.6, compared to 35.9 for NVIDIA.

These low valuation ratios for Intel are a clear signal of investors’ lack of confidence in the company’s prospects. They reflect market concerns about Intel’s ability to successfully transform its business and regain its position as a technology leader. While competitors, notably NVIDIA and AMD, enjoy high valuations reflecting optimism about their future growth, particularly in the areas of AI and advanced computing, Intel is viewed with more caution.Forecasts for next year suggest that Intel will maintain a relatively low valuation with a forward P/E of 18.7.

Is Intel in danger of being removed from the Dow Jones and other major indices?

Because of the decline in stock prices, Intel’s importance in stock indexes has clearly declined, which also has implications for ETF buying. In the S&P 500, the most important Wall Street index, Intel’s share fell to 0.19%. That’s a sizable drop from more than 1% a few years ago. A similar trend can be seen in the NASDAQ-100 index, where Intel weighs in at just 0.59%. Of particular concern is Intel’s position in the Dow Jones Industrial Average index. With a share of just 0.334%, the company ranks last in this prestigious index. Such a low share threatens to expel the oldest Wall Street index at the next revision.

On the chart, Intel is back to 2012

Looking at the chart from the perspective of the last several years, we see a return of prices to 2012 levels, although 3 years ago the company was worth 3 times as much. Looking at Nvidia, on the other hand, the company’s shares are more than 100 times higher now than they were in 2012. From the perspective of possible further declines, it is worth noting the local lows near $13, which were recorded in 2002 and then in 2009. At the same time, however, it seems that the company still has good enough prospects to bounce back from the bottom.

Source: xStation5

An uncertain future with a tight schedule

Intel is facing a key moment in its history as it seeks to regain its leadership position in semiconductor manufacturing. The company is pursuing its IDM 2.0 strategy, announced in 2021, which aims to restore Intel’s competitiveness against TSMC and Samsung. The strategy is based on three pillars: expanding production capacity with leading process technology, increasing the use of external factories to meet internal needs, and transforming into a world-class semiconductor manufacturer.

The company’s aggressive timetable for the introduction of new processes calls for Intel 4 (7nm) to be put into production in 2024, followed by Intel 3 and Intel 20A (2nm) in 2025, and finally the groundbreaking Intel 18A (potentially 1.8nm), whose development has been accelerated. The company has already made significant progress, beginning volume production on the Intel 3 process for both internal and external customers. The process offers significant improvements, including a new FinFET transistor design and high-density cell structure. So far, competing ‘technology’ chips are produced almost exclusively by TSMC.

In parallel, Intel is expanding Intel Foundry Services (IFS), opening its factories to external customers and gaining strategic partnerships. One example is a deal with Microsoft worth more than $15 billion to produce custom chips. According to the industry, 18A is able to compete effectively with TSMC’s N3, which represents a diversification opportunity for end users. Intel faces serious competition from TSMC, which currently dominates the advanced manufacturing market. TSMC predicts that by 2028, more than 20% of its revenue will come from the production of AI processors, with an annual growth rate of 50%. This shows how fast the AI market is growing and how important it is for Intel to keep pace in this area. The continued reliance on TSMC products carries risks that could materialize with a change of power in the US or China’s approach to the semiconductor industry.

Intel is investing significantly in new production capacity, including the expansion of existing factories and the construction of six new factories in Arizona, Ohio and Germany. These investments are supported by significant government subsidies and customer commitments. The company is also investing in breakthrough technologies such as EUV lithography, RibbonFET (GAAFET) and PowerVia (backside power delivery).

To compete successfully with TSMC, Intel must not only deliver on its technology promises, but also attract more customers to IFS with competitive pricing and manufacturing quality. It is necessary to prove that the company can effectively manage production for external customers while maintaining the high performance of its own products.

Intel expects that the majority of production in 2025 will still be based on Intel 7 and Intel 10 processes, which could limit the margin benefits of introducing new EUVs. The company continues to lead the way in terms of money spent on R&D. Intel spends twice as much as second-ranked Qualcomm and continues to develop its products.

Intel aims to offer a wide range of services from semiconductor manufacturing to full systems development. This approach reflects the changing demands of the market, especially in the context of the growing computational needs of generative artificial intelligence.

The company’s success will depend on timely execution of technology plans, successful customer acquisition for foundry services and effective cost management. Ultimately, the company could become a competitor to TSMC in the contract manufacturing market.

Summary

Intel is facing a key moment in its history. If it successfully executes its IDM 2.0 strategy, including the development of advanced technology processes and foundry services, it could create an interesting investment opportunity.

The current low valuation of Intel’s shares compared to its competitors suggests that the upside potential is significant if the company succeeds. Particularly important will be achieving Intel 18A competitiveness and improving operational efficiency. If these goals are successfully achieved, Intel could not only regain its lost market position, but also become an important player in the fast-growing AI and advanced computing sector.

For investors who are willing to take risks and patiently wait for the results of the transformation, Intel’s stock could be an interesting option with the potential for significant value growth in the long term.