Bussiness

Iran attacking Israel could impact crude prices – London Business News | Londonlovesbusiness.com

Crude oil futures advanced after OPEC+ decided to delay an output hike by one month.

This move extends the existing output cut of 2.2 million barrels into December, responding to falling prices and weak demand.

This delay may reflect OPEC+’s commitment to supporting prices more than expected, which could create a near-term bullish outlook for global crude prices. By maintaining tighter supply in the market, OPEC+ may help stabilize prices and encourage upward price momentum.

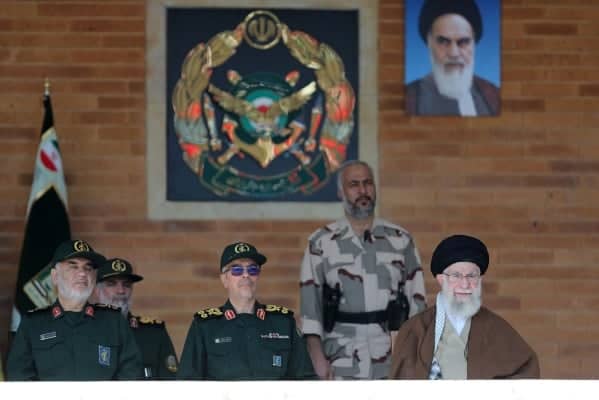

While recent price increases suggest bullish sentiment, there is caution about the sustainability of this trend. Risks of oversupply remain, raising doubts about continued gains. However, the Middle East situation, particularly the risk of potential Iranian actions against Israel, could impact market sentiment, further supporting the recent rebound in global crude prices.

In addition, several key events on the horizon, such as the U.S. presidential election and important economic meetings in China, could create some volatility in the market.