Bussiness

Nvidia becomes the biggest stock on Wall Street – London Business News | Londonlovesbusiness.com

Nvidia has become the largest company listed on Wall Street, and thus also the most valuable company in the world.

It took it only 96 days to grow from $2 trillion to $3 trillion in capitalisation.

The ongoing AI boom is often compared to the dot-com bubble, and Nvidia itself is compared to Cisco Systems – the hero of the Internet boom.

In March 2000, Cisco became the largest company listed on the U.S. stock market, a decade after its debut, reaching a valuation of $500 billion.

Shareholders, however, did not enjoy Cisco’s position in the market for too long. The year 2000 proved to be the end of the bubble and a completely different outlook on company valuations. Does a similar fate await Nvidia, a newly minted Wall Street star?

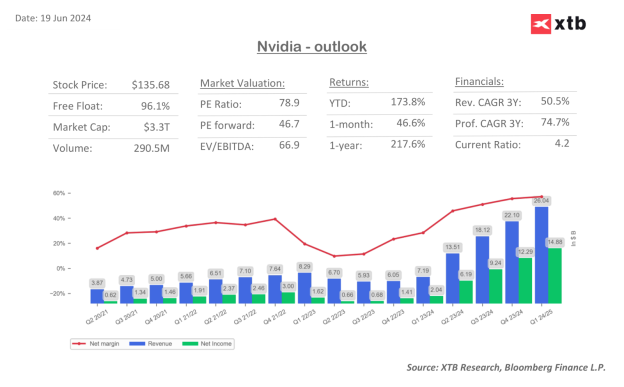

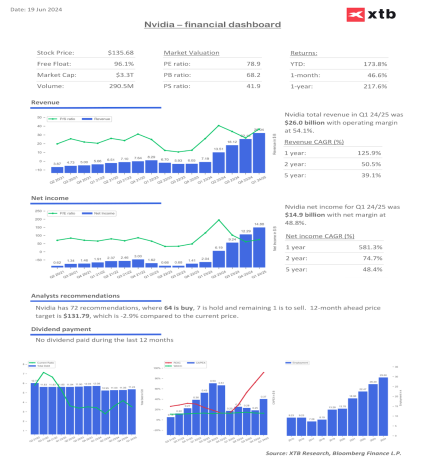

On June 18, Nvidia surpassed the stock market valuation of Microsoft and Apple and is worth about $3.34 trillion today.

The company needed only 96 days for its valuation to rise from $2 trillion to $3 trillion. Microsoft and Apple took 945 and 1,044 days, respectively, to do so. In contrast, it took the company 262 days to increase its capitalisation from $1 trillion to $2 trillion, compared to 786 and 749 for the aforementioned two largest companies, Microsoft and Apple. Source: XTB Research, Bloomberg Finance L.P.

In the 1990s, Cisco’s business growth was driven by sales of GSR routers and network switches, which proved to be a scarce commodity, during the Internet technology revolution. Today, Nvidia is a major manufacturer of GPUs necessary for the development of artificial intelligence and a provider of all AI-oriented service infrastructure. It’s not hard to guess that as of 2023, the company is seeing unprecedented improvements in a business that was doing very well before AI hit the headlines.

Demand for Nvidia chips is outstripping the available supply, the company is hiking margins and dominating a market niche that is very difficult to enter.

Have investors who take the continued growth of Nvidia’s business almost for granted lost touch with reality and are overvaluing the stock? Will the company repeat the history of Cisco Systems and, most importantly, what unites or divides the AI trend observed today with the Internet bubble?

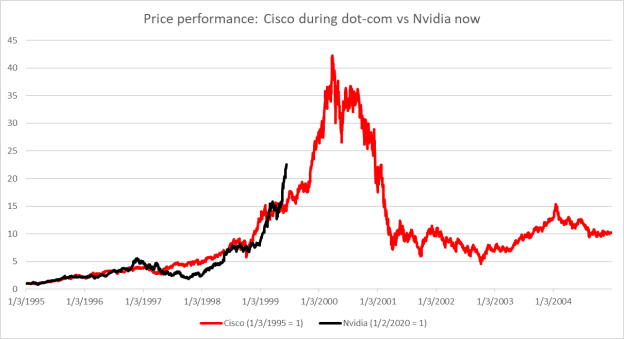

Superimposing a graph of Nvidia’s share price appreciation (black line), on Cisco Systems (red line), we see that the increases over the 2020 to now period are not yet on a 1:1 scale similar to Cisco between 1995 and 2000. Source: XTB Resarch, Bloomberg Finance L.P.

What differs Nvidia from Cisco and the AI trend from dot-coms?

Comparing the dot-com bubble home to the AI trend does not seem fully justified.

The dot-com boom was based on increases in the valuations of relatively new businesses that were just debuting on the market and promised to earn more by having an online presence.

For example, the shares of dot-com bubble bursting companies like CMGI, Yahoo, Amazon, and Ebay debuted on Wall Street in 1994, 1996, 1997, and 1998, respectively. This time the situation is radically different, with the increases narrowing to a dozen technology companies.

In the case of AI-related companies, the valuation increases are mostly in the case of large, technological (and non-debt) companies like Nvidia, Microsoft, Alphabet, Adobe and Dell with mature and proven business models.

This is no coincidence, as the AI business is very expensive, and already here we see something that definitely differentiates the ‘internet’ from artificial intelligence today.Investors with easier access to data today are calculating carefully and betting on companies that not only promise, but present real performance improvements, thanks to AI.

Improved market efficiency resulting from more widespread access to data (after all, we have the Internet) may limit the valuation errors made by investors in the late 1990s.

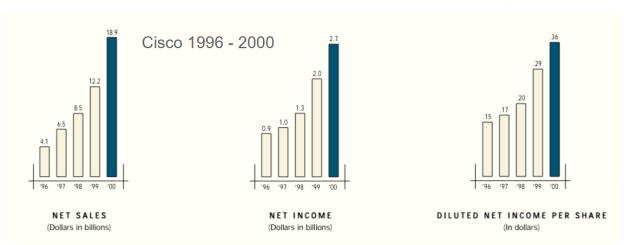

The scale of Nvidia’s business is also incomparably larger than Cisco Systems. In 2000, Cisco had $2.7 billion in net income, while Nvidia reported $14.8 billion in net income in Q1 2024 alone.

At the peak of the bull market, Cisco’s sales in 2000 were $18.9 billion, while Nvidia reported more than $26 billion in revenue in Q1 of this year alone and more than $60 billion in 2023. Nvidia’s advantage is also evident in terms of margins. While Nvidia’s net margin currently exceeds 50%, Cisco’s margins were less than 15% at the time of the best moment for the company.

Cisco’s expansion model has also relied heavily on acquisitions of private businesses – there were dozens of such acquisitions over the course of 1999 and 2000 alone. Nvidia relies on organic growth tied to demand from its largest customers, which include global technology companies such as Alphabet (Google), Microsoft, Amazon, and Tesla, among others.

Cisco’s sales, net income and diluted earnings per share from 1996 to 2000. source: Cisco Systems.

In 1999, Cisco competitor Juniper Networks debuted with products that by 2000 had ‘gobbled up’ about 30% of the switch and router market, dominated by Cisco. Several months after ChatGPT became available in the fall of 2022, dozens of new language models and other AI tools had already been released.

However, Nvidia maintained its dominance in 2023 with about 98% share of high-performance graphics chip shipments to data centres. This share has remained virtually unchanged since 2022 and is currently unchanged, despite the powerful market being the object of many chipmakers’ sighs.

Competition in the form of Advanced Micro Devices or Qualcomm still seems a long way from gobbling up Nvidia’s share (which doesn’t mean it won’t increase it in the horizon of the next few years). It will probably take place more gradually, and no product will be able to grab a few tens of percent market share, in a single year.

Nvidia’s business advantages are not the result of product developments over the past few months; the company has dominated for years as a supplier of the highest-performing graphics chips to the gaming and scientific sectors.

Dot-com similarities – is history repeating again?

As with the Internet bubble, news of AI deployment is now receiving a lot of attention from investors and often results in dynamic increases in stock prices.

Nvidia’s first place on Wall Street’s podium also marks the first time since 2000 that a computer infrastructure provider has earned the status of the most valuable company on Wall Street. Former Cisco CEO John Chambers assessed that, too, the implications of the AI trend appear to bring benefits to businesses similar to the Internet or cloud computing (although the dynamics and scale of the change are different).

In the memorable year 2000, Chambers wrote that the Internet-driven industrial revolution had just begun, and that the Internet was driving demand for Cisco products among all countries and companies, and supporting the strength of the US economy. Many of these words are reminiscent of today’s comments by Nvidia CEO Jensen Huang.

The dot-com boom continued, at a time when interest rates in the United States were high and hovering around 7%.

We can say that the high risk-free rate (bond yields) both then and now do not discourage investors from buying stocks. In part, this is due to the premium in valuations resulting from the Internet revolution at the time, and business efficiency improvements now expected, due to AI.

Investors today are trying to assess the impact of generative artificial intelligence on the business models of many companies, and awareness of the ongoing technological revolution is prompting purchases of tech stocks.

But let’s not forget that in 2000, when Cisco wrote that the company was in the midst of this revolution and was seeing improvements in every business segment, the stock took a dive.

In 2001, in the face of recessionary signals, the Fed was forced to make as many as 11 rate cuts, and these were preceded by declines in stock prices; as investors began to estimate a decline in demand and sales at many Internet companies, in the face of weakening consumers and a slowing US economy.

While the overall health of the U.S. economy currently remains good, in recent months we have seen some signs of declining demand, weighed down by higher interest rates.

However, this is not a slowdown big enough for Wall Street to start seeing today’s weakness as a signal of recession. Weaker data is now being interpreted as a guarantee of faster Fed policy easing and thus a ‘soft landing’. Nevertheless, between 1995 and 2000 there was also a widespread belief in the strength of the US economy.

Cisco Systems’ 9.9% average year-over-year sales growth in the decade 2000 – 2010 remained high against sales growth in tech companies (2.9%) and the S&P 500 as a whole (3.4%), but did not protect the company’s shares from ‘repricing’ and stock market valuation slide.

What’s more, sales in the decade from 2010 to 2020 fell and remain lower, suggesting demand for the company’s core products is being met. The company’s stock closed the decade at around $20 per share, compared to historical highs of $80 reached in March 2000, when Cisco was the largest U.S. company on Wall Street.

This shows well the situation in which Nvidia’s business may be growing, during the ongoing trend of scaling artificial intelligence, but this may not at all translate into a further increase in the price of its shares, if the market overvalued the expansion dynamics early in the trend.

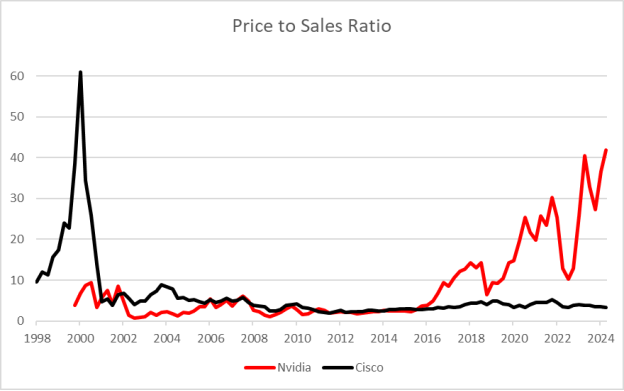

Cisco’s price-to-sales ratio grew exponentially between 1998 and 2000, and eventually found itself at levels higher than the current one for Nvidia.

After the massive expansion, the ratio never returned to its former levels and today, some 30 years after the beginning of the ‘Internet bubble,’ Wall Street does not see Cisco’s business as particularly promising. Valuations of U.S.-listed companies, not just Nvidia, are now mostly lower than they were in the last straight of the 1990s. Historically, however, they remain high. Source: XTB Research, Bloomberg Finance L.P

Summary

‘Details’ aside, the euphoria around Nvidia stock and artificial intelligence resembles that of the dot-com era, and to some extent comparisons to Cisco Systems are valid. Investors are once again crazy about a new technological revolution that will usher in leaps and bounds in many industries – from manufacturing to services.

They are willing to pay more for shares of AI companies; we see this with many Nasdaq companies, which are able to post double-digit gains, increasing capitalization by tens of billions of dollars from session to session… thanks to mentions of new AI products, or higher earnings forecasts, driven by AI.

The incredible optimism around Nvidia’s business is perfectly captured by photos of autographs handed out to investors by CEO Jensens Huang. We can cautiously assume that in this case history will not repeat itself, but the final will rhyme. As with dotcom, the biggest threat to Nvidia may turn out to be not competition, but recession, which would reduce the scale of AI chip orders and cool the market euphoria.

As history has shown, a hypothetical crash need not necessarily put the brakes on the entire artificial intelligence trend, which is undoubtedly revolutionary.

After all, Cisco’s precipitous decline in 2000 was not a harbinger of the end of the Internet revolution, but the result of overly high stock valuations and widespread optimism that discounted the powerful growth rate too quickly.

The question, therefore, should be not ‘if’ but when Nvidia’s shares will undergo a deep discount, since the increase in GPU orders is unlikely to last forever, or at least will not always be as dynamic as at the beginning of the nascent trend. In the long term, Taiwan, which is at the epicenter of geopolitical turmoil, from where TSMC produces GPUs for Nvidia, may also prove to be a certain threat to the company.

Nvidia stock price chart (D1 interval)

Nvidia shares have risen 180% since the beginning of the year and nearly 13 times since the local low in the fall of 2022; the obvious catalyst for sentiment around the company and the AI trend was the public release of ChatGPT from OpenAI, November 30, 2022.

Looking at the geometry of the market and the extent of the upward wave, lasting since May, we see that on June 18, when Nvidia became the largest company on Wall Street, the scale of the upward impulse was 1:1 coincident with the last impulse, followed by a correction (ended in late April and early May).

The company’s shares rose nearly 70% after its fiscal Q1 2025 (calendar Q1 2024) results. Nvidia’s stock price volatility is very high and resembles a small-cap company, despite the huge valuation of the company as a whole, suggesting huge capital inflows recently.

Source: xStation5

Source: xStation5

Nvidia financial indicators

Forecasts and selected valuation multipliers for Nvidia shares. Source: XTB Research, Bloomberg Finance L.P

The compound annual growth rate (CAGR) of 581% over the past year reflects the momentum of Nvidia’s business expansion. Profits and revenues from the data center segment dominate, although gaming has been the main revenue stream in recent years. Source: XTB Research, Bloomberg Finance L.P.