Bussiness

September 2024 Bank of England preview: Waiting for November – London Business News | Londonlovesbusiness.com

Having delivered the first Bank Rate cut of the cycle at the August meeting, the MPC are likely to stand pat this time around, instead waiting for the November meeting, and forecast round, before further removing policy restriction.

Nevertheless, any hints on the policy outlook, coupled with the annual review into quantitative tightening, could provide some areas of interest for market participants.

As noted, the MPC are likely to leave Bank Rate unchanged at 5.00% at the conclusion of the September meeting, electing to hold steady, and continuing to examine the impact of August’s 25bp cut, the first cut of the cycle.

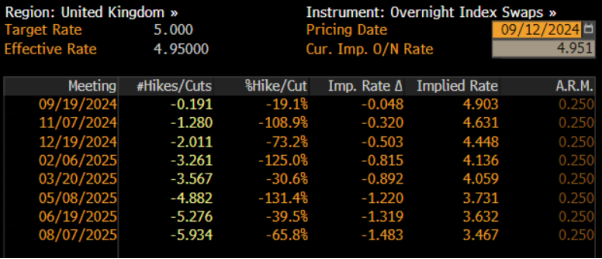

Money markets, per the GBP OIS curve, are well-priced for such an outcome, discounting just a negligible 18% chance of a second straight Bank Rate cut, though said pricing is subject to change, depending on the August CPI figures, due just a day before the 19th September BoE decision.

In contrast to the knife-edge 5-4 vote in favour of a cut last time around, the vote split at the September meeting seems set to be a much more straightforward affair, even if MPC officials have seldom spoken publicly of late, making it somewhat difficult to discern individual policy views. Nevertheless, the August statement set a relatively high bar for further policy easing, with the ‘Old Lady’ set to plot a much slower and steadier course back towards neutral than that of other G10 peers.

This time around, an 8-1 vote in favour of maintaining Bank Rate seems the most likely outcome. Three of the four hawks from August – Chief Economist Pill, plus external members Greene and Mann – are again likely to favour Bank Rate remaining unchanged; the fourth, Jonathan Haskel, has now left the MPC. That said, his replacement, Alan Taylor, along with Governor Bailey, and his deputies Sarah Breeden, Clare Lombardelli, and Dave Ramsden, are all likely to favour rates remaining on hold this time around.

External member Dhingra, the resident uber-dove on Threadneedle Street, will probably favour a second straight 25bp cut, though there is a risk Ramsden may also land in this camp, given his stance of voting for a cut back in June, earlier than almost all of his MPC colleagues.

Accompanying the vote split is likely to be policy guidance that remains broadly unchanged from that delivered at the August decision. Once again, the MPC will likely reiterate that policy must remain “restrictive for sufficiently long” until the risks of inflation persistence have further diminished, while also repeating that a ‘meeting-by-meeting’ approach to policy making will continue to be followed. In light of this, the curve discounting 50bp of easing by year-end, and 150bp in the next twelve months, seems rather over-ambitious.

Since the August meeting, the UK economy has continued to evolve broadly in line with the MPC’s expectations.

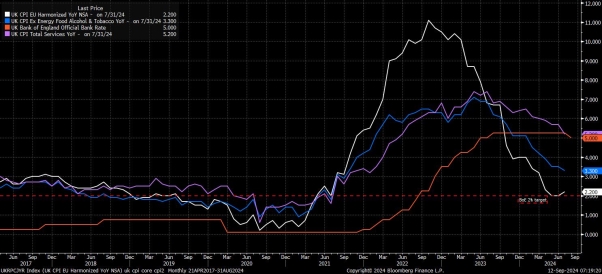

Headline inflation ticked higher in July, to 2.2% YoY, though such a rise was almost entirely due to the base effect produced by energy prices, which fell less this summer than in 2023. Underlying inflation metrics show that the broad-based disinflationary trend remains intact, with core CPI having fallen to 3.3% YoY, a near 3-year low, and services CPI having fallen to 5.2% YoY, a 2-year low.

The risks of inflation persistence have also further receded by virtue of developments in the labour market. Regular pay rose by an annual 5.1% in the three months to July, the slowest such increase in a couple of years, while overall pay rose by 4.0% YoY over the same period, the lowest increase since the tail end of 2020. While both are still too hot to sound the ‘all clear’, the direction of travel remains promising.

Unemployment, meanwhile, declined to 4.1% in July, a further fall from the 4.4% cycle high seen during the second quarter, and substantially better than the BoE’s 4.4% Q3 2024 forecast. Data issues, however, continue to plague the ONS’ Labour Force Survey, with policymakers continuing to place relatively little weight on measures of labour market slack, owing to low survey response rates, and higher-than-usual volatility in the figures.

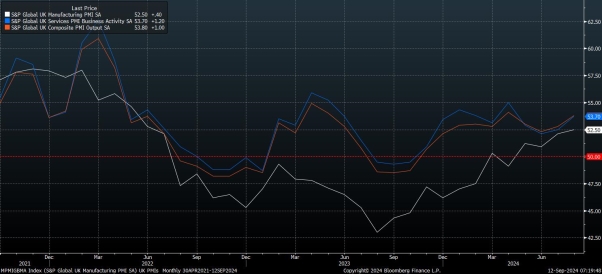

The growth outlook, however, is a little more mixed. Despite the manufacturing PMI rising to a 26-month high in August, and the comparable services gauge having remained in expansionary territory for 10 straight months, ‘hard’ data tells a more pessimistic story. GDP growth stagnated, on an MoM basis, in both June and July, with the rolling 3-month growth rate falling to 0.5%, almost entirely due to the growth seen in May.

This slowdown in GDP growth, however, is not entirely surprising, with it having always seemed unlikely that the economy would maintain the strong pace of growth seen in the first six months of 2024. Downside risks, though, continue to grow, particularly as geopolitical tensions remain elevated, and ahead of the anticipated fiscal tightening to be delivered in October’s Budget.

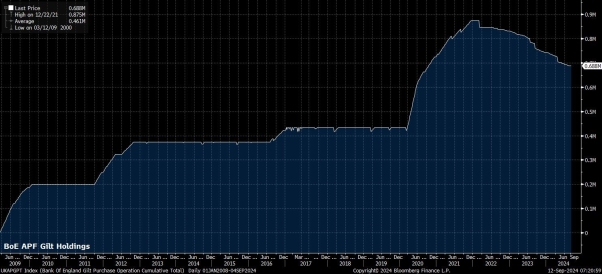

Away from the economic outlook, the other main area of concern for market participants at the September BoE meeting will be the MPC’s updated views on quantitative tightening (QT).

Since September 2022, the Bank have not only engaged in ‘passive’ QT, by letting maturing securities roll-off the balance sheet in order to reduce its size, but also ‘active’ QT, conducting gilt sales at a pace of £50bln, comprising roughly half of the £100bln annual balance sheet shrinkage. While such sales have been surprisingly well-received by financial markets, they also have the effect of crystallising significant losses for Government, due to the rise in interest rates which has taken place this cycle.

Of course, with the MPC being independent, these considerations should not influence their decisions as to how QT will evolve over the next year; the Bank giving a ‘helping hand’ to the new Government by slowing QT would not be viewed favourably by market participants.

Nevertheless, there are a few other moving parts here. Usage of the Bank’s short-term weekly repo operations has continued to sky-rocket during the summer months, with repo rates having also increased, implying a shortage of cash within the financial system, which could be alleviated by slowing QT, and thus increasing liquidity. However, policymakers, including Governor Bailey, have flagged that they expect usage of these repo operations to continue to increase as the balance sheet shrinks, and do not appear particularly perturbed by these developments just yet.

Furthermore, one could argue that the balance sheet is currently working against the aims of reducing Bank Rate. Clearly, the MPC have reached the stage in the cycle where policy restriction can now begin to be removed, even if the pace of rate cuts will be relatively gradual. Reducing the size of the balance sheet, however, acts as a tightening in financial conditions, thus inhibiting some of the impact of Bank Rate cuts as they are transmitted through the financial system.

On the other hand, 2025 brings a temporary spike in gilt redemptions meaning that, if the overall pace of QT were to remain unchanged at £100bln per annum, active sales would fall to around £15bln, a sizeable and perhaps unnecessary slowing in the pace of balance sheet reduction.

There is, then, a case for the MPC to actually quicken the pace of QT at the September meeting, in order to ensure that the rate of active sales remains the same. While the ‘path of least resistance’ would, probably, be to leave QT settings unchanged, participants should be alert to a potential quickening, and subsequent headwinds that this could pose to gilts.iew

For the GBP, the September MPC decision seems unlikely to be a game-changer in any way. However, the decision should once again reiterate how the ‘Old Lady’ is taking a more gradual approach to policy normalisation than most of her G10 peers, potentially underpinning the GBP in the medium-term, so long as the recent run of economic resilience also continues.