Bussiness

Wall Street continues to dump gold in June – London Business News | Londonlovesbusiness.com

The major gold exchange-traded funds (ETF) in the US continued to record more outflows during last June, completing a half-year in which they lost more than $4 billion in investor funds.

In June, two of the largest physical gold ETFs, SPDR Gold Shares (GLD) and iShares Gold Trust (IAU), recorded over $406 million of outflows despite a relative decline in the price of the yellow metal and stability near $2,330 per ounce after reaching the highest level in May at $2450.

The outflows from gold ETFs came despite the global geopolitical tension and the outbreak of wars in the Middle East, Africa and Ukraine, and most importantly of all, the People’s Bank of China continued to buy bullion for 18 months in a row until last April.

The following chart shows the net flows of major gold ETFs during the first half of this year:

Source: ETF.com

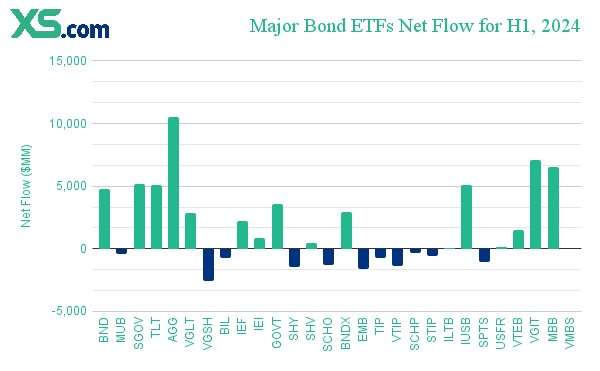

In contrast, bond ETF continued to attract significant inflows. The largest bond funds, with more than $10 billion in assets under management, with various holdings of treasury, government and broader market bonds, collected net inflows of more than $40 billion during the first six months of the year, and this is what the following chart shows:

Source: ETF.com

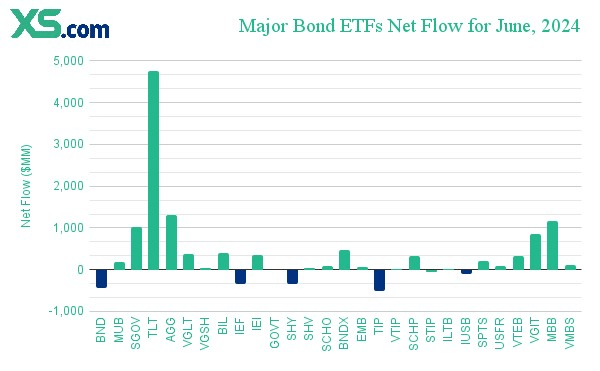

In June alone, more than 9 billion of net flows went to these funds, representing 20% of the total for the first half and the second fastest pace during the year after May, which recorded more than 11 billion. The following chart shows net flows in June as well:

Source: ETF.com

This trend has been to benefit from high interest rates and expectations that they will remain higher-for-longer, which is what keeps bond yields and ETF prices at attractive levels for investors. That is the resilience of the labor market and the improvement of economic activity little by little, even in light of difficult credit conditions, gives comfort to the Federal Reserve to keep rates higher-for-longer.

While 10-year Treasury bond yield stabilized above 4%, in June this is close to the highest yields that we have not seen since the global financial crisis in 2008, and in turn constitutes an opportunity to buy.

Investors also benefit from the inversion of the yield curve and the rise in short-term bond yields in a very attractive way for invest and reinvest the successive dividends from bond ETFs throughout the year. For example, the yield on three-month Treasury bills is at 5.38%, which is close to the highest levels since the beginning of the millennium. Accordingly, the largest short-term bond ETFs recorded net inflows of more than $1.7 billion in June, at the fastest pace this year, after the huge outflows of last February of more than $4 billion.

These opportunities may last at least to September, with the Fed not expected to cut rates earlier than that. While we may not see more than one or two cuts this year, and inflation may not stabilize at its target before 2026, as expected by members of the Federal Open Market Committee in the latest Summary of Economic Projections. While the probability that the central bank will cut the interest rate to the range of 5.25-5.00 is about 60% and 51% in September and November, respectively, according to the CME FedWatch Tool.

This increasing trend in investing in these ETFs comes despite the superior performance of the stock market and the rise in risk appetite as recession fears recede. This also comes despite the inherent negativity of bond ETFs, which is represented by the loss that the investor may receive from the fluctuation of the funds’ prices, with their high sensitivity (duration) to changes in interest rates and their expectations, while the nominal value of the bond can be recovered at its maturity without any losses when investing directly. But just as bond ETFs are hurt by a rise in interest rates, they also benefit from a fall.

Mortgage-backed securities (MBS) ETFs recorded further inflows in June, albeit at the slowest pace in three months at nearly $703 million for two of the largest funds, iShares MBS (MBB) and Vanguard Mortgage-Backed Secs Idx Fund (VMBS). These ETFs appear attractive due to the returns they yield, but the declining performance of the housing market may make investors more cautious, as new and pending home sales and housing starts recorded a weaker-than-expected performance last May. As for housing starts specifically, they fell in May to the lowest levels that we have not seen since the outbreak of the COV-19 epidemic in 2020, also coinciding with the highest historical levels of home prices.

As for Treasury Inflation-Protected Securities (TIPS) funds, they recorded mixed performance last June. These ETFs are exposed to decreasing inflation and rising interest rates, while it seems that the return of price growth to accelerate more than once this year may curb the outflow slightly. The Schwab U.S. TIPS (SCHP) recorded net outflows of about $325 million in June. This fund, in addition to another group of major TIPS ETFs, recorded net outflows of more than $3 billion during this year in total.

Returning to gold, it still maintains some supportive factors that may bring back some of Wall Street’s lost attention to physical ETFs. The approaching presidential elections in the United States add more uncertainty, as the victory of the Republicans may cause widespread significant changes in the local and global scene – the Middle East and Ukraine in particular. Add to this the political uncertainty in Europe with the expected shift in the party landscape across the continent with the balance tilting towards far-right parties.

The Middle East, in turn, does not show any signs of the possibility of ceasing the raging conflict in Gaza, the continuation of which, along with the stagnation of the negotiating track, may open more fronts in the region or may extend beyond it. This is what may push the price of gold to more historical levels, as was the case when it was recovered from the level of $1,800 per ounce last October.

While it is not unlikely that the People’s Bank of China will continue to accumulate gold bullion in the coming months at a remarkable pace. That is the pause in May appears to have coincided with very high levels of the price of the yellow metal, and the central bank may wait for some decline in prices to continue purchasing.